- Homeownership

- Multifamily Housing

- Nonprofit Facilities

- Special Programs

- Property Managers

- For Investors

SEPTEMBER 2017 | DOWNLOAD PDF | CURRENT ISSUE | PAST ISSUES

Rural

Housing in Washington State:

Same Pressures, Unique Needs

The housing challenges in Washington’s rural areas are mounting.

Fortunately, we have rural leaders who are up to the challenges. This

issue of My View focuses on rural headwinds and the many creative people

and impassioned efforts to build and preserve affordable rural housing.

Tight housing markets + population growth = burdens for rural communities

Housing for Washington’s Farmworkers

Infrastructure: The bane of rural development

Preserving the housing we already have

HopeSource: Taking action in central Washington

Fostering homeownership in rural areas

“Mobile-home” parks: Preserving and empowering communities

Partners for Rural Washington: Amplifying the voice of rural

As many of our readers know, I began my housing career developing affordable housing in rural areas. Not only did I learn about the federal programs that serve rural America, I worked side-by-side with the people who live in our rural communities and helped them build their homes using USDA’s Self-Help Housing program. Some challenges in rural housing are not unique: high infrastructure costs, loss of subsidized housing, low rental vacancies and rapidly increasing construction costs. However, rural areas have other unique problems: fewer local and federal resources, lower family incomes, smaller communities and longer distances to travel. That’s why, from time to time, I like to refocus on the rural programs in Washington State and remind myself that we have great people meeting those challenges in our rural communities. I hope you enjoy reading about them.

top of page /\

Tight housing markets

+ population growth

=

burdens for rural

communities

In Washington’s urban areas, as a result of booming economic and population growth, the lack of affordable housing is becoming a mounting crisis. But this overshadows the fact that many parts of rural Washington are also growing—and struggling with housing conditions.

Marty Miller

Executive Director, Office of Rural and Farmworker Housing (ORFH)

“This is one of the potentially lesser-known

housing crunches in our state. We’re just not meeting the demand for

affordable rentals in rural areas.”

Marty Miller is executive director of Yakima-based nonprofit Office of Rural and Farmworker Housing (ORFH), a developer and partner in building and preserving housing for low-income people across rural Washington. He also currently serves as president of the National Rural Housing Coalition.

Talking with Marty about what he sees as a statewide affordable housing developer, you get a clear picture of how every rural community is unique. But there are also common denominators.

The squeeze on rural renters

One of these near-universal problems: lack of rental vacancies. “This is one of the potentially lesser-known housing crunches in our state,” Marty says. “We’re just not meeting the demand for affordable rentals in rural areas.”

Our state’s rural residents rent at a rate greater than the national average. Data from Housing Assistance Council (HAC), based on the 2010 Census, placed Washington’s numbers for rental housing vs. owner-occupied housing for rural and small town residents at 31.7%. (The national average was 28.4%). 1 As HAC notes in Rental Housing in Rural America: “The imbalance of owner-occupied housing may not be based entirely on preference, as there is a dearth of rental homes and rental options in many rural communities.” 2

A “dearth” is an understatement. Marty points out that vacancies in Chelan County were 0.6% at the end of the fourth quarter of 2016. In Yakima County that number was about 1.6%. Ellensburg’s vacancy rate is less than 1%, according to Susan Grindle of HopeSource. Vacancy numbers are similarly grim in the 10 counties in eastern Washington served by her organization, including Kittitas, Okanagan, Douglas, and Grant Counties. Over on the far western tip of the state, Kay Kassinger of the Peninsula Housing Authority reports that Clallam County is experiencing about a 3% vacancy rate, while in neighboring Jefferson County, she notes, “the rate is getting pretty close to zero.”

Add to these constraints the fact that many rural communities are not experiencing the economic recovery seen in America’s cities and urban regions. In its Rural Research Note, “Economic Expansion Eludes Rural America,” HAC states:

Overall, the nation’s median household income (2015) experienced its first annual statistically significant increase since 2007. Easily overlooked in this generally positive report was the finding that rural areas experienced a decline in median household income ($45,534 in 2014 to $44,657 in 2015) … The estimated 2 percent decline in rural median household income is in contrast to the statistically significant 6 percent increase in incomes for metropolitan areas. 3

Thus, it’s not surprising that 47% of U.S. rural renters are cost burdened, with nearly half of that number paying more than 50% of their monthly incomes for housing. Rural renters also typically live in older housing than rural homeowners—35% of renter-occupied units were built before 1960.4

ORFH recently helped complete Brender Creek, a seasonal development

for farmworkers in Cashmere.

How do low-income people make do? “Doubling up is extremely common. As are substandard conditions,” Marty says. One form that this takes is what he calls “unsubsidized affordable housing.” This includes manufactured homes in mobile home parks, which are often old and, in many cases, both substandard and overcrowded.

Kay brings up one “solution” to securing affordable housing: Moving to a different county. In Port Townsend, the county seat of Jefferson County, affordable housing is so scarce that the city changed its ordinance so that its police officers are no longer required live there. In the case of at least one officer, “they couldn’t find anything in Port Townsend or in Jefferson County, so they moved to Clallam County.”

top of page /\

Housing for Washington’s Farmworkers

Historically, ORFH’s work has focused on farmworker housing. “As an organization, we were founded on the principle that farmworkers, like everyone else, deserve a decent place to live,” Marty explains. “But we’re really trying to address the broader spectrum of rural affordable housing needs.” Most of ORFH’s projects are in central Washington, but they also work with partners on the west side of the Cascades and in eastern Washington. Partners include nonprofits, housing authorities, and associations such as the Washington Growers.

Guadalupe Ramirez, who farms hops in the Yakima Valley, lives in

Granger in an apartment complex built for farmworker families.

Small farms greenhouse in Federal Way.

The number of Washington farmworkers and their families who are not adequately housed is hard to pin down. Based on statistics from the Employment Security Department, the State Department of Agriculture, and the National Ag Workers Survey (NAWS), “our best guess is there’s usually anywhere from 125,000 to 150,000 farmworkers—just farmworkers, not their dependents—in Washington State in any given year,” Marty says. Of that number, about 75% are typically year-round residents of their communities, though some may travel several hundred miles during harvest times. The remaining 25% are truly migrant farmworkers.

To address the needs of non-permanent farmworkers, ORFH also helps develop quality-built seasonal homes. Marty points to a versatile seasonal development they recently helped complete in Cashmere, Brender Creek, which was built in partnership with the Washington Growers League. It can house up to 200 individuals.

On the west side—where several years ago, a group of farmworkers sued a large Skagit berry grower over lack of access to seasonal housing—ORFH is now in the beginning stages of a seasonal development with the Housing Authority of Skagit County.

Housing the spectrum in Prosser

On the permanent housing side, right now, ORFH and their partners are busy completing Phase 2 of a three-phase development in Prosser. All three phases illustrate the range of needs many rural communities face: Phase 1 is 50 two- and three-bedroom rental townhouses for farmworker and other low-income families; Phase 2 is senior housing; and Phase 3 will be new homes for affordable homeownership.

Unfortunately, the Prosser experience has also demonstrated that NIMBYism can still crop up—even where you’d least expect it. Though their team went through “quite a long process in identifying a piece of land for [Phase 1], we needed to change sites because of some local perceptions that farmworker housing was going to have a negative impact,” Marty says. This, despite the fact that Prosser sits in the heart of Yakima Valley agriculture. “But there still can be the perception that farmworkers are somebody else and not a part of our community. We heard comments like that very distinctly in this process. Many people were also supportive and wanted to see this happen.”

For the senior housing of Phase 2, slated for completion this fall, Catholic Charities Housing Services of Yakima is the development sponsor. “We know there’s really strong demand and I think it’s going to be a very fast rent-up,” he says. With only one affordable housing property for seniors in Prosser currently, the project will help address this acute need.

This begs the question: If there’s such a demand, why not build more units? Marty brings up the challenge of scale in rural communities. In urban areas, he notes, affordable developments of several hundred units can make sense to serve housing needs; this kind of size also generates an economy of scale that is clearly beneficial on the operations side. But truly large-scale developments are both difficult to achieve and often out of context for a smaller rural community.

“In our rural communities, 50 or 60 units is considered a lot,” he says. “Residents can often even look at that as ‘Holy cow, this is going to really change our community’—even though our experience is that you’re most often just providing better housing for people who already live there.”

Public investment is greatly needed

Marty brings up two final points. One concerns the income disparities between mostly-urban counties like King County and its rural Washington counterparts. “This really impacts our work,” says Marty. In 2016, for example, a family of four in Yakima at 50% AMI made about $29,000. In King County, that number was about $48,000. “Both areas have significant affordable housing issues,” he says. “And affordability is a big deal, but at very different scales.”

What ORFH and many other housing developers and managers contend with when targeting families at 50% AMI and lower, Marty says, is making these developments pencil out operationally. A family that makes $48,000 a year can afford to pay more in rent than one that makes $29,000 a year—which helps service debt and contributes to the sustainability of that housing.

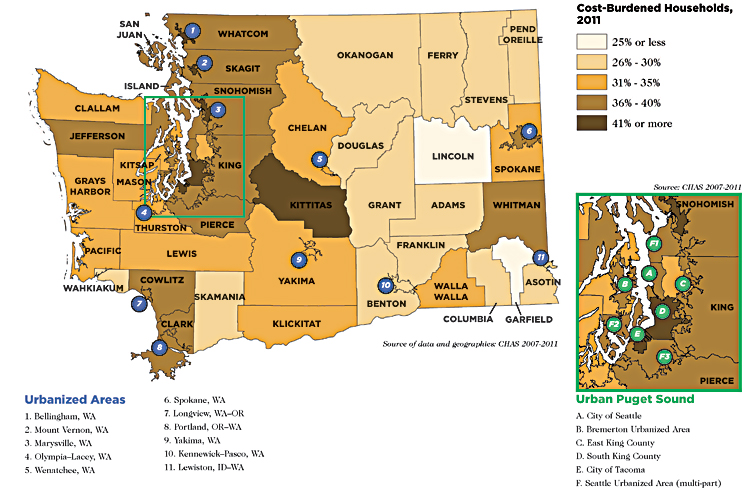

On the flip side, looking at the map of housing cost burdens in Washington State counties in the 2015 Housing Needs Assessment, you can see that poorer people pay more of their income for housing everywhere in the state. Except for five rural counties, at least two-thirds of our state’s extremely low-income residents, in both rural and urban counties, are cost-burdened—paying more than 30% of income on housing costs.5

“My general experience is that rural is a valuable sector of our communities that the private market is not able to serve on its own—there needs to be public investment, too,” he says. “Rural housing can’t be accomplished only with private funds. The math just doesn’t work.”

top of page /\

Infrastructure: The bane of rural development

Olympic Peninsula project shows obstacles to building in remote areas

In fall of next year, Peninsula Housing Authority’s (PHA’s) new development in Port Angeles will start coming on line. This first phase (of a proposed three phases) will replace 33 units built in 1942 with 63 new townhomes and apartments at Mount Angeles View Family Housing. The six-plus years and myriad funding partnerships needed just to get phase 1 launched has chapters and plot twists worthy of an epic novel. It’s also a testament to the PHA’s remarkable perseverance.

Kay Kassinger

Executive Director, Peninsula Housing Authority (PHA)

“We serve everyone out here. Here, you can’t

build a development dedicated to homeless households or all to disabled

households; you need to do a mix.”

Obstacle number one in this story: infrastructure. This massive redevelopment project is like building a new town—one with 21st-century requirements that weren’t in place during World War II.

“Of about $2 million in infrastructure improvements in building, water, sewer, electric, and city streets, I would say about $800,000 to $900,000 of that was addressing storm water based on the Department of Ecology’s requirements,” says Kay Kassinger, executive director of the housing authority.

PHA has to build the infrastructure in order to build the housing—but can’t afford to manage private, long-term infrastructure. “We want the city to take it on, which is another hurdle: to get them to agree. And then we have to build it to urban standards.” On top of that, they had to convince the Port Angeles City Council to approve reduced-width streets to help limit the amount of runoff, which in turn will reduce costs. Finally, the master plan for the Mount Angeles View redevelopment was approved by the City of Port Angeles in 2011.

Stitching together quilt of funding requires creativity and stamina

Next obstacle: Securing adequate funding has been no picnic.

“Being a rural community, we don’t have access to funding from housing levies like Seattle’s, for example. And, unlike Seattle and King County, we also don’t have an entitlement for CDBG [Community Development Block Grant] and HOME funds,” she says. 6

More populous cities and counties automatically receive “entitlement” allocations of federal CDBG money. Clallam and Jefferson, by virtue of their relatively small populations, aren’t “entitled” and must apply directly to the state for this funding.

“Everything we do, whether it’s HOME or CDBG, goes through the state and we have to compete for it. We wrote the grant, and the City of Port Angeles sponsored it for us. And the first time we applied we were turned down. The state said, ‘well, it’s just a storm water project.’ And we said, “No it’s not, it’s just that storm water’s the biggest part of our infrastructure!’”

Commerce ultimately granted PHA $750,000 in CDBG funds for the project. Next stop: The Housing Trust Fund. Securing $3 million from the HTF also required two tries. The first time, Kay reports, the feedback she received was that Peninsula needed to be more specific about the populations they were targeting with their housing.

Rendering of the redeveloped Mount Angeles

View in Port Angeles, which broke ground in August 2017.

“We serve everyone out here,” Kay says, pointing out another limitation for rural housing developers. “Here, you can’t build a development dedicated to homeless households or all to disabled households; you need to do a mix.”

With CDBG and Housing Trust Fund investments secured, plus some from HUD’s Public Housing Capital Fund, PHA headed to the Commission to compete for the Low-Income Housing Tax Credit. PHA secured a $12 million allocation of credits in 2016 and found an investor.

Now for the twist: The November elections. With tax-credit investors suddenly expecting major reform to the federal tax code, income-tax shelters became less attractive. The value of PHA’s credits fell from about $1.08 to 93 cents per credit. Their investor partner, nonprofit National Equity Fund, “stayed with us,” Kay says—but due to this fall in credit value, the project no longer penciled out.

“We’ve spent the last six months getting more money and cutting our project down. It’s been a herculean effort,” Kay says.

That effort has included cobbling together more funds from local sources, including Clallam County’s Opportunity Fund and a local bank. Kay also has an application in to the Federal Home Loan Bank. Mount Angeles View broke ground in August.

top of page /\

Preserving the housing we already have

USDA-funded apartments are disappearing from small towns

The USDA has a long history of supporting the economic challenges of low-income rural residents, including creating and preserving affordable rental housing and underwriting and guaranteeing loans to first-time homebuyers. Most of these programs have seen substantial cuts over the last two decades and are in danger of being cut further.

Mary Traxler

Washington State’s Multifamily Housing Program Director, USDA Rural

Development (RD)

“The impact has been hard on tenants in

western Washington. If that property is going to market-rate housing,

the tenant’s rent could go up 20 or 30% right away.”

Mary Traxler is Washington State’s Multifamily Housing Program Director for USDA Rural Development (RD). RD’s two programs for rural rental housing are Section 515 Rural Rental Housing Loans, and Sections 514 and 516 Farm Labor Housing Loans and Grants.

Section 515 has created hundreds of affordable properties all over the state over the past 40 years. RD is the direct lender, with about 270 rental properties. The borrowers include companies, private investment groups, HAs and nonprofits. (The section 514/516 portfolio is 30 permanent USDA-financed farmworker housing developments.)

This portfolio is in danger of disappearing. Developments are seeing their loans mature, losing their affordability covenants—and getting sold to the private market.

The average age of the Section 515 portfolio across the U.S. is 34 years. According to the National Rural Housing Coalition, it’s estimated that $5.5 billion will be needed over the next 20 years just to maintain and preserve existing USDA-financed developments. Of that number, $4.7 billion relates specifically to Section 515 developments. 7

Meanwhile, the Section 515 mortgages are maturing and not being replaced. In 2015, the USDA lost 205 properties—2,646 homes—from its portfolio nationally. And when these properties enter the private market, tenants frequently have no other affordable housing options.8 A senior housing development in a smaller rural community, for example, may be the only affordable option within a large geographical area. Some 30% of the state’s current USDA-financed properties are senior housing.

Since its peak in 1982, the nation’s Section 515 funding has been cut by more than 97 percent, from $954 million to just $28.4 million last year. 9

In Washington State, Mary says, “we’ve built less than five projects in the last decade. Virtually everything we have was built in the 70s, 80s, and early 90s. We have begun aggressively refinancing the properties that have reached full maturity.”

Preserving one property at a time

One way Mary’s division can save the affordability of this housing is through a USDA funding source called the Multi-Family Preservation and Revitalization program (MPR). MPR funds are allocated federally—not by state or by region. The program’s only eligible borrowers are those who currently hold 515 loans. “We can do debt deferral, we can do loans,” she says. In some years, they’ve had grant funding for nonprofits and HAs, but that hasn’t been available for several years.

MPR financing addresses one project at a time. With a debt deferral, a housing development’s owners can “bank that money and do repairs and rehab with it. These smaller debt deferrals make up the majority of MPR projects.”

Mary and her team are focused on doing everything they can to keep properties affordable to low-income tenants. Over the last five years, as loans have approached maturity, “we haven’t been able to catch all of them, but the last few years we have been able to re-amortize some very small balances—that way they get to stay in the program.”

HopeSource and Shelter Resources teamed up in 2010 to purchase and

rehabilitate Roslyn’s Pennsylvania Place Apartments, originally an USDA

RD property and now preserved as affordable for years to come.

Many borrower/property owners who have fulfilled their commitment to the federal government by providing low-income housing for the required number of years—typically 20 to 30 years—want to walk away. “If they want to retire, cash in their chips, and leave the program, we have no legal means to prevent that,” Mary says.

Our state is also losing properties out of the USDA portfolio to prepayment. This is particularly a challenge in western parts of the state where market values are increasing.

“In the last three years, we’ve had, on average, four properties pay off per year,” she says. “The impact has been hard on tenants in western Washington. If that property is going to market-rate housing, the tenant’s rent could go up 20 or 30% right away.” The vouchers provided to these displaced renters are portable, but since the voucher is for a fixed amount, tenants’ out-of-pocket costs for housing frequently rise: Chances are, there’s not going to be a comparably priced rental available to them. Mary mentions three properties that were recently sold at market rate in the Oak Harbor area on Whidbey Island. “Many of the tenants were displaced because they could not afford the rent increases.”

Legally, the request to prepay can’t be denied. But if the USDA finds that the sale will have disparate impact on any minority group, they can require that the owners list the property for sale and advertise to nonprofits for a period of six months.

Transfers of ownership

Transfers of ownership are a big bright spot in keeping at least some of this housing affordable to low-income people. Here at the Commission, we’ve worked closely with the USDA and other vital partners to save valuable properties in rural communities. This typically involves both the purchase and refurbishing of older properties, with a mix of these properties packaged together.

Low-Income Housing Tax Credits can be combined with a USDA loan guarantee through RD’s 538 program. The state Housing Trust Fund is also often an essential source of funding. As part of the transaction, USDA rental assistance to low-income tenants can be transferred, too. This is critical— granted when the property was first acquired or built, this rental assistance is rarely transferable to another property.

“Our budget for rental assistance has grown because the rents have increased, just due to increasing costs, but we’ve had no expansion of the program,” Mary notes. “And you know how difficult that is, given the fact that we’ve had such an expansion of affordable housing shortfalls.”

Although the six-month notification of sale window required to list these properties is nowhere near enough time to pull together complex financial transactions like these, Mary says that some owners have been willing to give nonprofits more time to pull together critical deals to save this affordable housing. Her team helps coach nonprofits to target properties that are maturing, “to contact our large multiple-property owners and get their action plan in place.”

top of page /\

HopeSource: Taking action in central Washington

HopeSource is one of the nonprofits leading the way in rescuing USDA-financed rural rental housing in our state. An Ellensburg-based Community Action Council (CAC), HopeSource is clearly taking the word Action to heart.

Susan Grindle

CEO, HopeSource

“We’re attacking the lack of housing on all

fronts, so we’re always looking for new sources of funding and gaps that

exist that we can fill across eastern Washington.”

Craig Kelly

Affordable Housing Director, HopeSource

“Six months to put a deal together would not

be enough time. So as long as the owner is willing to wait a year, two

years—and sometimes even three or four—that’s what we need to get all

the financing together.”

Susan Grindle is HopeSource’s CEO; Craig Kelly is affordable housing director. Both bring an entrepreneurial mindset to this work. “We’re attacking the lack of housing on all fronts,” Susan says, “so we’re always looking for new sources of funding and gaps that exist that we can fill across eastern Washington.”

The first of HopeSource’s USDA transfers was a 98-unit acquisition in 2012 of three properties in Roslyn and Ellensburg. Now, HopeSource is completing the rehab of six older properties totaling 146 units in the central Washington communities of Ellensburg, Cashmere, Selah, and Leavenworth that were part of an acquisition last year. These deals were made possible by a package of USDA financing, tax credits, HTF investment, and other sources.

In today’s tough conditions, great relationships with partners are also essential. For example, Shelter Resources has been HopeSource’s development partner in their USDA loan portfolio ownership transfers. “Their expertise in navigating the various funders’ requirements and deadlines ensured that our acquisition projects went through,” Craig says.

It helps, he adds, that Shelter Resources helped build USDA RD properties decades ago and is well connected with owners and developers. When properties are maturing or owners want to sell, “we get that information. But six months to put a deal together would not be enough time. So as long as the owner is willing to wait a year, two years—and sometimes even three or four—that’s what we need to get all the financing together.”

Unfortunately, many property owners aren’t willing to wait that long. “And so we lose these potential properties,” Susan says.

But this tactic is proving more successful than trying to build new. “There’s just hardly any dirt available for new builds,” Susan says. The last time HopeSource succeeded in building new multifamily housing was 2002. Thus, in 2008, the nonprofit’s board made the strategic decision to focus on the rehab market.

top of page /\

Homelessness is growing in rural areas

When HopeSource began looking for older properties to buy and modernize in rural communities, Susan explains, they saw many gaps in services for vulnerable populations. This led to HopeSource’s current grant to work with homeless veterans in six Washington counties. “There weren’t any facilities for veterans in this great middle northern part of the state, so we applied and filled that big, black hole for homeless veterans,” she says.

The trouble is that due to low rental vacancies, it takes a long time to get veterans into housing. Susan adds that in very rural areas in eastern Washington, “we can help with a few months’ rent for veterans to get into a place, but where is that place?” At times, their only option has been to broker deals with motels that have kitchenettes to set aside a certain number of units as long-term leases.

For non-veterans who are homeless, housing resources are equally thin. For example, Douglas County has a very high homeless population and not many units, Susan says. Grant County, which has high homelessness both in terms of individuals and homeless families, has none. HopeSource is therefore embracing a rapid rehousing model. Last year, they received a grant from Washington Youth and Families Fund to implement diversion strategies in Adams, Chelan, Douglas, Grant, Kittitas, and Okanogan counties. They’re also cultivating landlord relationships to help them access affordable housing that becomes available.

With rapid growth, housing resources just can’t keep up

From 2015 to 2016, Kittitas County’s growth rate of 4.2% made it the 10th-fastest growing county in the country. And its county seat, Ellensburg, was the third-fastest-growing “micro area” in the U.S. 10 The many factors behind this growth include more people moving east from crowded King County. Central Washington University is growing, too. Craig reports that CWU increased its student body in Ellensburg by 2,000 last year—while making available only 250 new units of student housing.

“We’re experiencing 4% growth every year—but we’re not increasing our housing stock by that amount by any measure,” he says. “Even market-rate units aren’t going up fast enough.” The same disproportionate story is true in Okanagan, Chelan, Douglas, and Grant Counties, Susan says. “There’s a huge influx of people coming into these counties.”

For the HopeSource team, a critical piece of the puzzle is building more self-sufficiency among the people they serve. HopeSource is now working with six Habitat for Humanity organizations across Eastern Washington. Their USDA grant is supporting capacity-building work with these small rural Habitat partners. As part of this work, “We’re training one to three volunteers in each Habitat to effectively coach families in basic skills that will ensure they make a successful and sustainable transition into homeownership,” Susan says.

top of page /\

Fostering homeownership in rural areas

Cody Wells and Catherine Jenson worked with Housing Kitsap’s

self-help housing program to build their new home in Poulsbo. USDA’s

Section 523 program provides technical assistance to Housing Kitsap and

seven other self-help partners in Washington.

Affordable homeownership is integral to the health of our rural communities, offering individuals and families the opportunity for greater stability and financial security. The increasing squeeze on affordable rentals makes homeownership accessibility all the more imperative.

Yet there are a host of barriers. Not least are lower U.S. rural median incomes, averaging about 20% less than the national median income overall. 11 Another huge barrier is the lack of access to affordable credit. According to one research study, rural areas “experience higher banking concentration than urban areas, resulting in less competition and consumer choice, higher prices, and ultimately, less access to affordable mortgage loans.” 12

Recognizing these barriers, a number of federal agencies have historically provided support for first-time and low-income homebuyers. These include:

The $3 billion Community Development Block Grant program

The HOME Investment Partnerships Program

The USDA Section 502 Direct Home Loan Program, which provides a direct subsidized loan to rural low- and very-low-income families in rural America

The USDA Section 523 Mutual Self-Help Housing Technical Assistance Grant program, which provides grants for construction training and financial education for rural self-help housing

HUD’s Self-Help Opportunity Program (SHOP), which provides grants to nonprofits that provide self-help housing assistance to communities, and HUD’s Community Development and Affordable Housing Capacity-Building Grant, which helps hire and expand staff.

Of course, like other federal programs that serve low-income and vulnerable populations, these are at risk in the annual budget process.

top of page /\

Self-help housing

Self-help housing is one of our nation’s great equalizers in helping lower-income people make the leap to a home of their own. The “sweat equity” provided by participants in these programs often serves to bridge that almost unbridgeable gulf between what people with limited means can afford, and the costs of labor, land, and materials to get even modest homes built. 13

Michone Preston

Executive Director, Habitat for Humanity Washington State

“This loan is also helping this affiliate

demonstrate their impact on the community so they can attract larger

donations. And get more homes built.”

Billie Heath

Rural Development Specialist, Rural Community Assistance Corporation

(RCAC)

“In one subdivision, families who just

finished construction will probably have $75,000 of equity when they

move in.”

I asked Billie Heath, rural development specialist at Rural Community Assistance Corporation (RCAC) who advises self-help programs through the USDA RD Section 523 program, and Michone Preston, Executive Director of Habitat for Humanity Washington State, to share what their partners are contending with in rural Washington.

Both Billie and Michone point to rising land and infrastructure costs and the changing landscape of available financing and public funding as among the mounting obstacles these self-help groups face.

Habitat for Humanity

I’ll start with Michone and Habitat. Of about 30 Habitat affiliates in the state, most—with the exception of King County—are in rural communities, Michone explains. These affiliates have helped build more than 1,600 homes. In 2015 and 2016 alone, they helped raise more than $26.5 million in charitable donations.

Often, “the biggest challenge is that there’s so little opportunity for other affordable housing developers that much of the weight of a community’s need falls on Habitat’s shoulders. And there’s so much more demand than we can provide.”

Each affiliate functions relatively autonomously; many may build just a few houses at a time due to limited resources. “Some of our most rural affiliates are far off the radar,” she says. And major funding sources like the HTF are typically off the table, as “we just can’t get to the scale where it attracts those kinds of dollars.

“Where our rural affiliates really struggle,” she continues, “is to get the funding and the expertise to go from being an infill-spot-lot builder to being more of a community builder where they could have some cost savings with some volume.” Many rural affiliates are still buying single lots or seeking to get them donated. Although large tracts of land can be available in rural areas, even if the financing was available, “they don’t have any infrastructure.”

top of page /\

Big wins for Habitat

During last year’s legislative session, Senate Bill 6211 was passed. This bill, a big win for Habitat and other affordable homeownership partners, makes vacant land slated for low-income homeownership tax-exempt for up to seven years. Only when transferred to a homeowner is property tax collected. This has already saved the state’s Habitat affiliates half a million dollars. “And we’re still getting them to sign up, so we’re not at our full capacity yet,” Michone says.

Another major win: A new financial partnership with the Commission. This low-interest financing program, which Habitat calls CHIP (Construction of Habitat Homes and Infrastructure Partnership Program), allows Habitat affiliates to jump-start new construction with larger loans.

CHIP’s first allocation of funding, in 2015, provided the Tacoma and Spokane Habitat affiliates each with a loan of $2.5 million. Last year, the affiliates in King County ($2.5 million) and Chelan County ($500,000) each received funding from the program.

“This program has enabled us to grow our volume,” Michone says. “For us, $8 million literally translates to 80 more houses over the last two years.” Michone points to the impact for Chelan County, where the affiliate has used some of the funding to complete a few houses under construction and to bring water, sewer, and streets to a 12-home site under development. “It absolutely has changed the face of this affiliate. There’s so much need for farmworker housing and service-worker housing in Chelan, but the rents are just sky-high from tourism and recreation.

“Mobile-Home” Parks:

Preserving and Empowering Communities

Often overlooked and even derided, “mobile home” parks are an important

form of affordable housing, especially in rural areas.

Often overlooked and even derided, “mobile home” parks are an important

form of affordable housing, especially in rural areas.

But in most parks, although the resident might own the actual home, the

land is leased from the landowner. This makes the owners uniquely

vulnerable to rent hikes, lack of maintenance, and especially sale of

the land from under them—all too common as land prices rise.

When the land is sold, these homeowners (seldom in a position to move

their homes elsewhere) lose any investments they made in their homes and

are thrown into the market for scarce affordable housing. The land is

usually developed for retail or market-rate housing—a net loss of

affordable housing in the community.

Several nonprofit organizations, such as the Association of Manufactured

Home Owners, are helping to empower these communities. And one important

tool is cooperative ownership—when homeowners join together to purchase

the land under their homes.

The Commission has partnered with ROC USA and ROC Northwest to finance

the purchase of ten such communities in Washington state—from Moses Lake

to Puyallup, Duvall to Whidbey Island.

ROC Northwest (part of the Northwest Cooperative Development Center)

provides technical assistance to help neighbors get organized, decide if

they want to be a cooperative, and take the necessary steps. The

residents each purchase a share in the co-op, paying a monthly fee

(sometimes only $10 more than their previous rent payments). They also

elect a board of directors.

For the purchase of the land, the Commission and ROC USA step in with a

tailor-made loan with favorable terms. Often, the loan finances not only

the purchase, but critical improvements to the property, as deferred

maintenance is very common.

The result is a revitalized and empowered community of neighbors.

Before: Rising rents, poor maintenance, rules set by the landlord, and

insecurity. After: a bright future of long-term security, collective

investment in improvement and maintenance, self-made rules, and

affordability.

“I see more and more of our community catch ‘co-op fever’ and it is

inspiring!” says one community leader. “The sense of community and pride

is awe-inspiring at times.”

“What this loan is also helping this affiliate to do,” Michone adds, “is to be competitive—to demonstrate their impact on the community—so they can attract larger donations from foundations and other funding sources. And get more homes built.”

Helping rural communities use federal resources

Billie brings tremendous expertise and perspective to her role as a technical advisor to self-help housing programs. She began this work with RCAC 38 years ago, and has been working in Washington State since 1987. In acknowledgement of her deep commitment to this work, the Commission recognized her as a Friend of Housing in 2015.

Billie helps people and local state housing programs take advantage of USDA’s Section 523 Mutual Self-Help Housing Program. In rural Washington, this program has helped build and rehab more than 3,000 affordable homes. Right now, Billie is working with eight rural self-help programs that stretch from the Columbia River to the San Juan Islands.

RCAC’s newest partner is Spokane Tribal Housing Authority. Originally, Billie and the HA had explored working together on new construction on the reservation through the Section 523 program. But the infrastructure challenges and costs common to building on remote individual allotments—no central electricity, water, or sewer—made it unworkable. Instead, the partnership will focus on rehab. Homeowners who need house repairs can contribute their labor and create a cost savings.

In their self-help builds in western Washington, Billie says, “Most of the time we have it fairly easy because communities are linked to a large metro area and they can sometimes get support and figure things out. In the smaller communities on the east side, adding onto a water or sewer system is not easy to finance. It’s a catch-22: How do you pay for development?”

To finance these rural self-help homes, Billie’s housing partners typically rely on the USDA’s Section 502 Direct Loan Program. Through Section 502 Direct, the federal government directly subsidizes home loans, extending its reach to very-low-income families—an average income of $28,268 in 2013, versus an average family income of $48,000 under the guaranteed-loan program. 14

If Section 502 Direct is axed, as cuts loom on the federal horizon, the low-income families Billie helps serve will be stuck: They rely on elements of this loan targeted to self-help programs. These kinds of financial transactions are complex, involving upfront construction loans that ‘flip’ to a permanent mortgage once the home is completed, with the value of the sweat equity translated into a downpayment. “We have yet to find a partner in the private market who’s willing to do the self-help use of the guarantee program. We’re still looking,” Billie says.

With all the hard work and umpteen challenges, it’s an enormous achievement when families complete their homes and move in. “I did hear something awesome,” Billie says. “In one of the subdivisions over in Kitsap and Poulsbo, families who just finished construction after a year-plus will probably end up having $75,000 of equity when they move in. They’ve earned it.”

What’s her take on the USDA programs in jeopardy in the federal budget? “I’m not going to jump out the window just yet,” Billie says. “We know we’re going to have to work very hard with our congressional representatives to make it clear that these programs are critical for rural areas. …It’s just unfortunate—we end up spending a lot of time and resources doing that.”

top of page /\

Partners for Rural Washington: Amplifying the voice of rural

I’ve known Mario Villanueva for close to 40 years; his has always been a voice for the underserved and underrepresented people who live in our rural communities. He grew up on a farm and has worked on rural challenges from virtually every perspective: as a private builder, as director of a nonprofit in Mabton that renovated housing for the poor, as a developer at ORFH, and in leading housing management for the Diocese of Yakima Housing Services. He’s also served with us as a Commissioner. Most recently, Mario was Washington State’s Director of USDA RD from 2009 to January 2017.

Mario Villanueva

Board Secretary, Partners for Rural Washington

“It doesn’t take much to see the need … A

little town like Mattawa, for example, in the farmworker housing there

that I’ve been involved with—they have 200 people on the waiting list

for that housing.”

Now, with the help of many partners, Mario is engaged in a new enterprise: building the fledgling Partners for Rural Washington (PRWA) from the ground up. I’ve joined this effort: Mario recruited me to serve as board president of PRWA. A key objective for PRWA is, in Mario’s words, “To elevate the profile of rural concerns and the voice of rural in Washington.”

Rural development councils were created across the U.S. in the late 1970s, with the help of the USDA, to maximize public resources in rural economies. Washington state’s first council didn’t survive. What drew Mario to reignite a council for our state “was the idea that working together and being mindful of the concerns of our communities, we could do a better job of meeting the needs of rural people. We want to help share information, to leverage and maximize resources—not just town by town but region by region.” PRWA officially came into being in 2014, when the USDA and other partners sponsored a statewide conference in Ellensburg.

We now have a great board that includes representatives from Commerce, HUD, RD, WSU Cooperative Extension, and nonprofit organizations. We also have people on our board who represent tribal and healthcare concerns. What PRWA still needs, Mario emphasizes, is “more representation from rural communities, mayors, and city council members.”

PRWA’s first two initiatives have been to convene local meetings on rural issues, and to create a web-based Rural Resource Directory, a guide for Washington’s rural communities on water, waste water, housing, healthcare, economic development, and other resources. Mario recently participated in a five-town listening tour across rural Washington—in La Conner, Tenino, Pateros, Chewelah, and Dayton. Along with representatives from Commerce and the Association of Washington Cities, he heard from some 30 communities about their priorities.

High-speed broadband and affordable housing

The number-one concern that came out of these convenings? Dependable high-speed broadband, Mario says. Being connected is critical for a host of reasons, not least in preserving and attracting jobs in rural communities. But what about affordable housing?

“When you talk to farmers, and when you talk to the folks that live in little towns like Bingen, housing needs are prominent,” Mario says. Bingen is part of the five-county Oregon/Washington region straddling the Columbia River served by the Mid-Columbia Economic Development District (MCEDD). “MCEDD’s number-one issue is housing. And ask Mike Gempler [Executive Director] of the Washington Growers League. His number-one issue is housing.

Partners for Rural Washington visited five towns across Washington

for a listening tour of local rural issues.

“It doesn’t take much to drive around and look—and you can see the need,” Mario continues. “In little towns like Rosalia or Chewelah or Sunnyside. In some of the more blighted neighborhoods, you see clearly the need for decent, safe, affordable housing. A little town like Mattawa, for example, in the farmworker housing there that I’ve been involved with—they have 200 people on the waiting list for that housing.”

Leadership, knowledge, and solidarity

Mario mentions another big priority for PRWA: Leadership development at the local level. “One of the factors that’s a determinant in community success is how well the people who care about that community are equipped to lead with knowledge, vision, and plans.”

He gives the example of Walla Walla’s Sherwood Community Trust. This foundation supports a regional leadership development program. It also partners with other local organizations in a program called Community Indicators that utilizes data to better understand trends and opportunities in the region. “Walla Walla knows the socioeconomic realities. That’s why their success rate is quite good with leadership development,” he says. “If you know the data, you can peel back the picture of needs when forming your local plans.”

It’s up to communities to determine what matters to them, yet many share similar concerns, Mario says. “Because rural has fewer people, our voice doesn’t have a lot of political clout. But if we can aggregate and amplify that rural voice, we should be able to get more done together.”

top of page /\

1. Source: HAC Tabulation of 2010 Census of

Population and Housing,

“Rental Housing in Rural America,” HAC

Rural

Research Note, April 2013 (www.ruralhome.org).

2. Ibid.

3.

“Economic Expansion Eludes Rural America,” HAC

Rural Research Note,

September 2016 (www.ruralhome.org).

4. Ibid, “Rental Housing in Rural America.”

5. 2015 State of Washington Housing Needs Assessment, pg. 56.

www.commerce.wa.gov/housing-needs-assessment.

6. HUD’s HOME Investment Partnerships Program (HOME) provides formula

grants to states and localities to create affordable housing for

low-income households.

7.

2017 Impact Report, National Rural Housing Coalition, pg. 13 (www.ruralhousingcoalition.org).

8. Ibid.

9. Ibid.

10. United States Census Bureau, quoted in article

“Kittitas County 10th

fastest growing in the country,” Daily Record, March 28, 2017 (www.dailyrecordnews.com).

11.

Opening Doors to Rural Homeownership: Opportunities to Expand

Homeownership, Build Wealth, and Strengthen Communities, National Rural

Housing Coalition, December 2012 (www.ruralhousingcoalition.org).

12. David C.Wheelock,

“Banking Industry Consolidation and Market

Structure: impact of the Financial Crisis and Recession.” Federal

Reserve Bank of St. Louis Review, November/December 2011 (www.research.stlouisfed.org).

13. Past issues of My View have explored our state’s self-help housing

programs: Habitat for Humanity in August 2008; USDA rural self-help

housing in October 2006; and Community Frameworks’ Self-Help

Homeownership program in April 2005. See

wshfc.org/newsletter/archive.htm.

14. Rural Housing Service, 2015 Explanatory Notes (www.obpa.usda.gov).

Through the USDA’s Section 502 Guaranteed Loan Program, rural families

with incomes up to 115% AMI can obtain affordable home mortgages from

approved private lenders, which receive a 90% guarantee from the USDA.